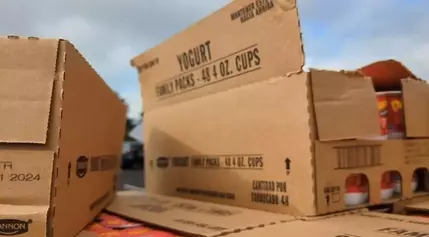

FAO Food Price Index firm in June: higher vegetable oil, sugar and dairy prices offset lower cereal quotations [EN/AR/RU/ZH]

Navigating the Shifting Tides of Global Food Prices

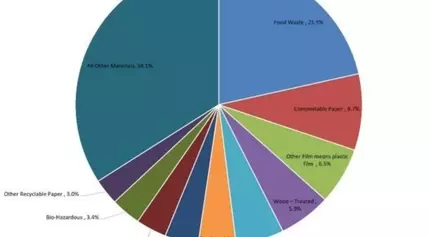

The global food market has been a dynamic and ever-evolving landscape, with a complex interplay of factors influencing the prices of various commodities. The latest report from the Food and Agriculture Organization (FAO) sheds light on the intricate dynamics that have shaped the food price index in recent months, offering insights into the factors driving these fluctuations and the potential implications for consumers, producers, and policymakers alike.Uncovering the Nuances of Global Food Price Trends

Cereals: Balancing Supply and Demand

The FAO Cereal Price Index has seen a notable decline in June, with a 3.0% drop from the previous month and a 9.0% decrease compared to the same period last year. This downward trend can be attributed to a combination of factors, including seasonal pressures from ongoing harvests in the northern hemisphere, improved production prospects in major exporting countries, and the implementation of a temporary import ban by Türkiye. Additionally, larger-than-expected planted areas and generally favorable crop conditions in the United States have contributed to the softening of maize export prices. The decline in barley and sorghum prices has also played a role in the overall decrease in the cereal price index.Vegetable Oils: Shifting Dynamics and Demand Patterns

In contrast to the cereal market, the FAO Vegetable Oil Price Index has experienced a 3.1% increase in June, reaching its highest level since March 2023. This upward trend has been driven by higher quotations across palm, soy, and sunflower oils, while rapeseed oil prices have remained relatively stable. The rebound in international palm oil prices can be attributed to a reviving global import demand, as the commodity has become more price-competitive. Meanwhile, the continued rise in soy and sunflower oil prices is underpinned by firm demand from the biofuel sector in the Americas and declining export availabilities in the Black Sea region. The tightening global supply outlook for the 2024/25 season has also contributed to the elevated rapeseed oil prices.Dairy: Shifting Demand and Supply Dynamics

The FAO Dairy Price Index has experienced a 1.2% increase in June, standing 6.6% above its corresponding value a year ago. This upward movement has been driven by a rise in international butter prices, which have reached a 24-month high, fueled by increased global demand for near-term deliveries and seasonally falling milk deliveries in Western Europe. Additionally, low inventories in Oceania, coinciding with the region's lowest point in milk production, have also influenced the butter price dynamics. The skim milk powder prices have also increased, primarily due to steady imports from Eastern Asia and somewhat high internal sales in Western Europe. In contrast, cheese prices have decreased slightly, reflecting a slowdown in global import demand for near-term deliveries.Meat: Divergent Trends and Shifting Patterns

The FAO Meat Price Index has remained virtually unchanged from May, standing 1.8% below its corresponding value a year ago. This stability masks the underlying divergent trends within the meat market. While a decline in international poultry meat prices has been observed, driven by abundant supplies from some leading producing countries, the prices of ovine, pig, and bovine meats have experienced moderate to slight increases. The rise in ovine meat prices can be attributed to the continued high import demand and the liquidation of herds by farmers in response to unusually dry conditions in parts of Australia. The increase in pig meat prices is driven by a steady pace of imports and seasonally active internal sales, particularly in North America. Meanwhile, the global demand-supply conditions for bovine meat have remained broadly stable.Sugar: Navigating Weather-Driven Volatility

The FAO Sugar Price Index has experienced a 1.9% increase in June, following three consecutive monthly declines, but remains 21.6% lower than its value in June of the previous year. This uptick has been primarily triggered by lower-than-expected harvest results during May in Brazil, which have heightened concerns over the potential impact of prolonged dry weather conditions on sugar production in the coming months. Additionally, erratic monsoon rainfall in India and a downward revision to crop yield forecasts in the European Union have also contributed to the overall upward pressure on world sugar prices, which has been partially offset by the weakening of the Brazilian real against the United States dollar.

![FAO Food Price Index firm in June: higher vegetable oil, sugar and dairy prices offset lower cereal quotations [EN/AR/RU/ZH] FAO Food Price Index firm in June: higher vegetable oil, sugar and dairy prices offset lower cereal quotations [EN/AR/RU/ZH]](https://img.royaweb.io/news/1809a51f5f01952398c755bdb8b84e62.webp)